Tariff Adjustments and Distribution Reforms Show Positive Impact

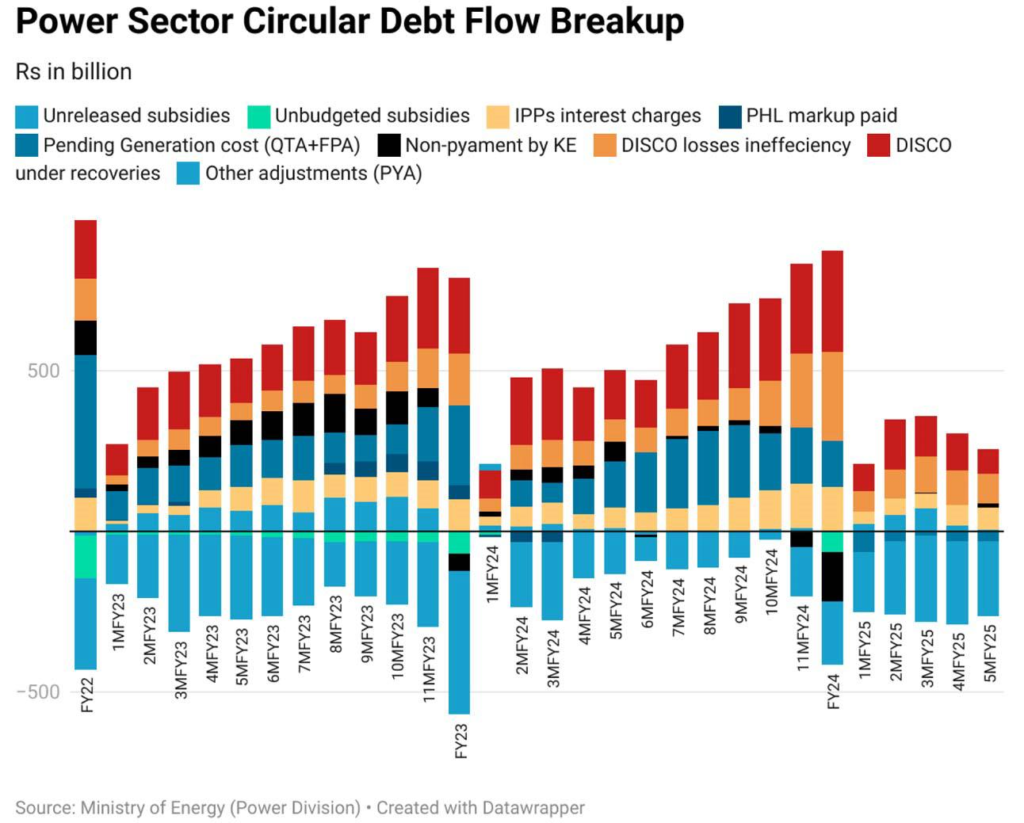

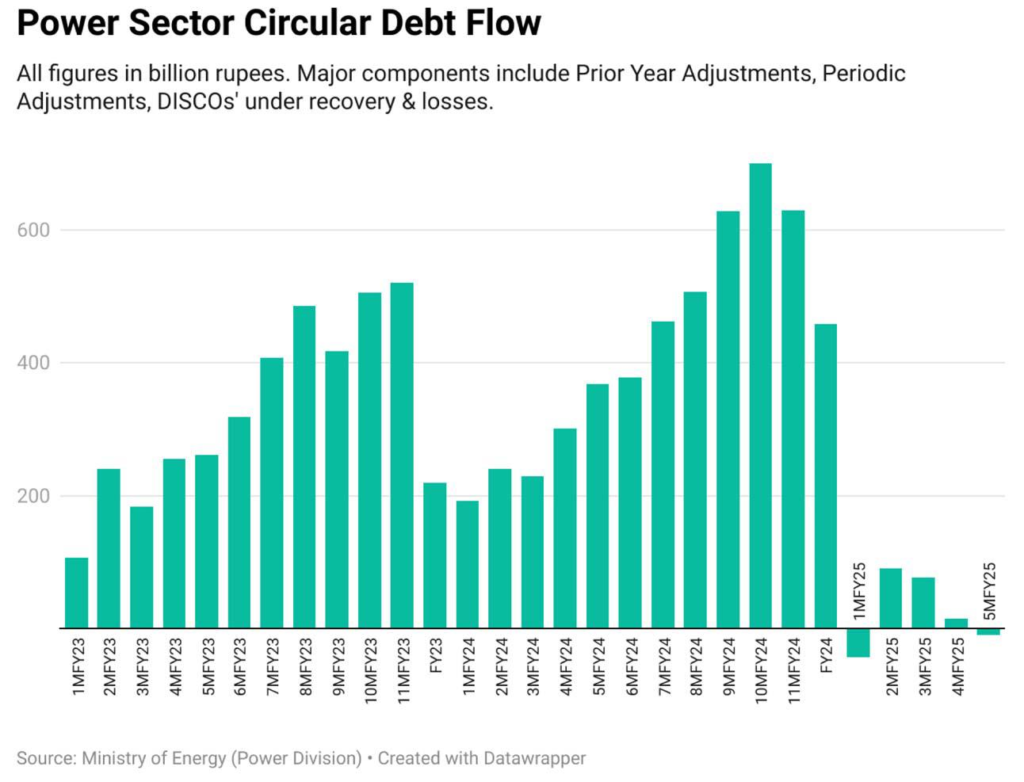

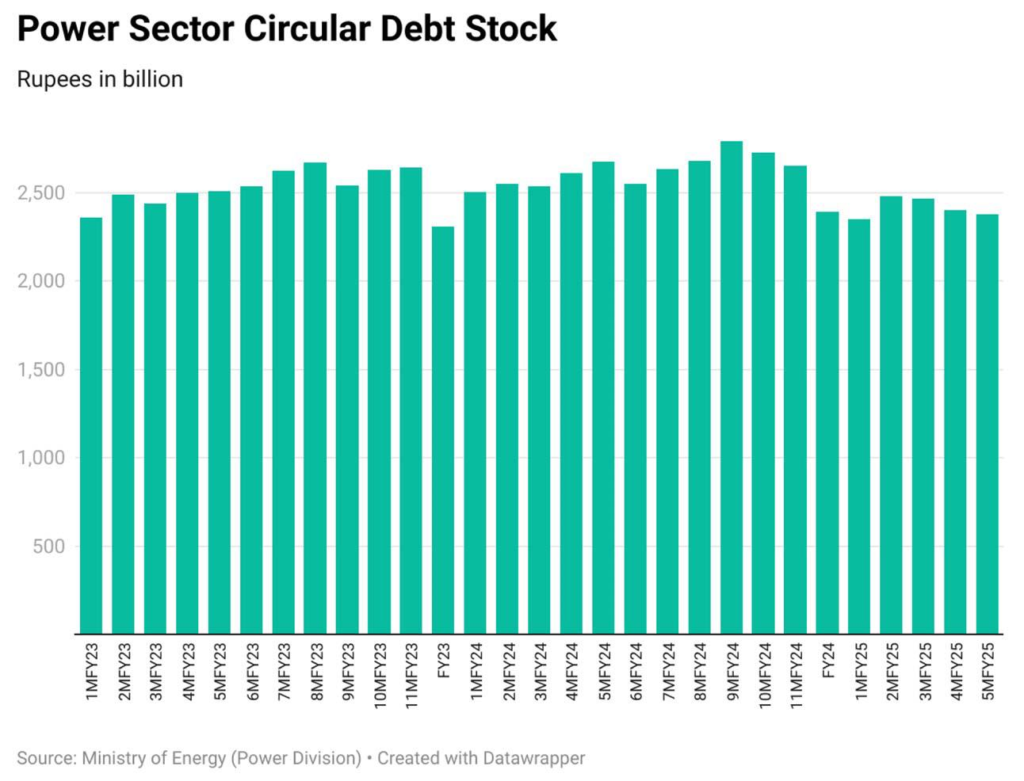

Pakistan’s power sector circular debt accumulation has significantly slowed down in the first five months of FY25, following the implementation of tariff adjustments and distribution reforms under the Circular Debt Management Plan (CDMP).

By November 2024, the circular debt stock stood at Rs 2.83 trillion, reflecting an Rs 380 billion improvement compared to the same period last year. Despite being Rs 11 billion below FY24’s closing level, the pace of accumulation has visibly decelerated, signalling a positive shift in the sector’s financial health.

Key Factors Behind Debt Slowdown

The biggest contributors to the slowdown include:

- Tariff Rebasing: Introduced in July 2024, freeing up nearly Rs200 billion from circular debt buildup.

- Automatic Tariff Adjustments: NEPRA’s regular quarterly tariff adjustments (QTAs) and monthly fuel cost adjustments (FCAs) helped prevent debt accumulation.

- Improved Revenue Recoveries: Under-recoveries were recorded at Rs76 billion by November 2024 the lowest in three years and 50% lower than the previous year.

- Lower Fuel Costs: Fuel prices remained below referenced tariffs, simplifying the adjustment process.

Privatization & Structural Reforms

The government is under pressure to meet the IMF’s structural benchmarks regarding the privatization of distribution companies (DISCOs). Concession arrangements for several DISCOs have been approved, while the first Request for Proposal (RFP) for privatization is expected by September 2025.

The success of these reforms hinges on:

- Timely implementation of the Transmission System Expansion Plan.

- Continued enforcement of automatic tariff adjustments.

- Resistance against political and bureaucratic pressures.

Outlook & Recommendations

While early signs are encouraging, experts caution that the last quarter of FY25 could see inefficiency-related losses rise. Authorities must maintain fiscal discipline and accelerate the pace of privatization and transmission projects to sustain the sector’s financial stability.